In its latest earnings call, U.S. steel producer Cleveland‑Cliffs announced a strategic shift: beyond supplying automotive‑grade steel, it’s actively exploring opportunities in the rare earth metals supply chain.

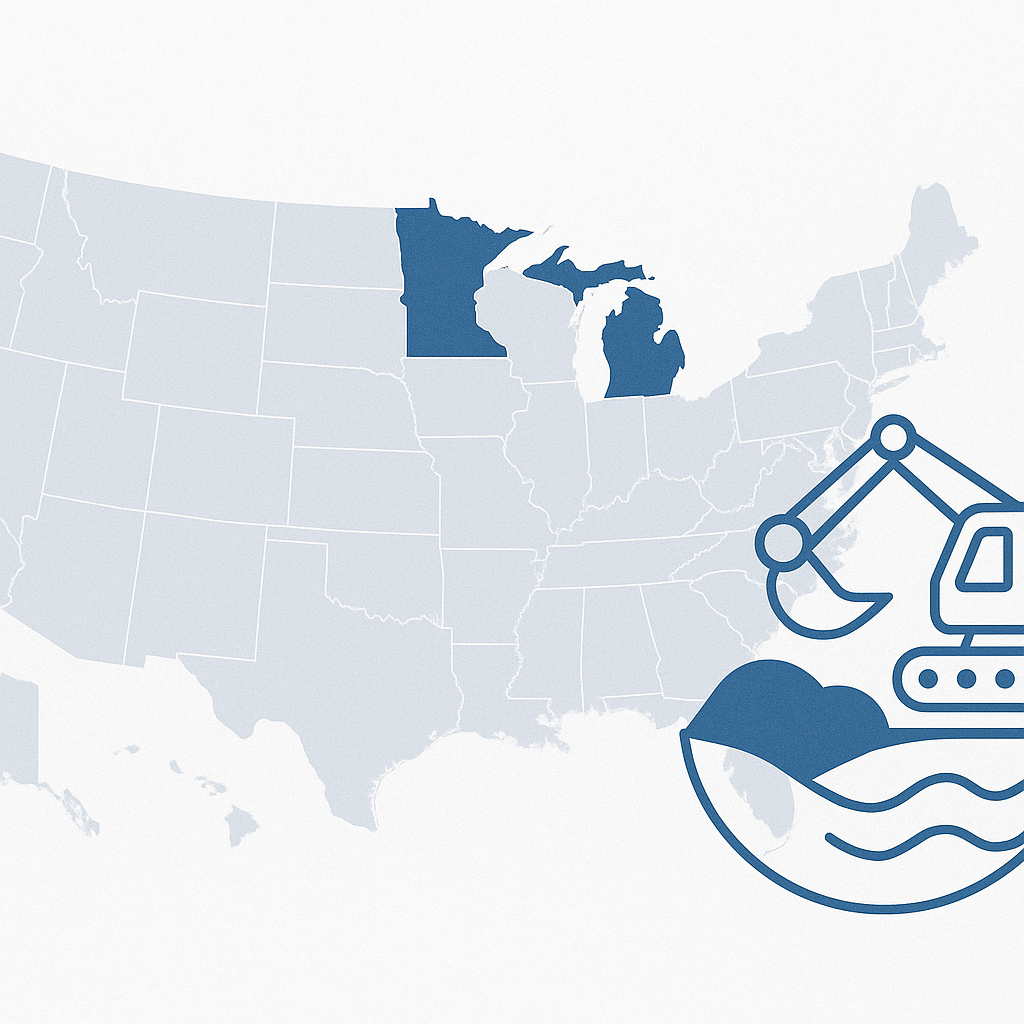

Exploring the Midwest for Rare Earth Minerals

Cleveland‑Cliffs revealed that it has identified two potential mining sites in Michigan and Minnesota, where geological surveys indicate signs of rare earth mineralization. While the company did not disclose specific minerals or their grade, the move signals a deliberate attempt to diversify beyond traditional steel production. CEO Lourenco Goncalves emphasized that the initiative “is squarely within the nation’s pursuit of critical material self‑sufficiency.”

The Strategic Context

This pivot comes amid broader supply‑chain concerns. The U.S. has long relied on China for rare earth elements used in electronics, magnets, batteries and glass. By exploring domestic rare earth deposits, Cleveland‑Cliffs is positioning itself to support a more resilient rare earth metals supply chain – a vital capability as industries seek to reduce dependence on foreign sources.

Simultaneously, the company noted stronger performance in its automotive steel business. Q3 revenue hit $4.7 billion, a nearly 4 % year‑over‑year increase. Goncalves described the quarter as showing the “first clear signs that the tide is beginning to turn.”

Automotive Steel Rebound and Trade Dynamics

Cleveland‑Cliffs serves major North American automakers including General Motors, Ford Motor Company, Stellantis, Hyundai Motor Company, Honda Motor Co., Ltd. and Toyota Motor Corporation. The company attributed part of the rebound to trade policy shifts (namely steel tariffs under Section 232 tariffs) and a pickup in restocking activity in distributor and end‑user markets.

Why This Matters for Manufacturers and Suppliers

For suppliers and vendors in the manufacturing chain, Cleveland‑Cliffs’ dual trajectory matters:

- Rare earth metals supply chain implications: By moving into rare earth mining, Cleveland‑Cliffs could contribute to more on‑shore sources of critical minerals, offering downstream manufacturers greater stability and possibly shorter lead times.

- Steel market recovery: As automotive OEM demand rebounds and trade pressures evolve, steel suppliers and service centers may see improved utilization and contract stability.

- Risk diversification: The company’s expansion into input minerals suggests a broader industrial strategy, signaling to partners and vendors that steel‑makers are evolving into multi‑material players.

What To Watch

- The outcome of Cleveland‑Cliffs’ geological assessments at its identified Minnesota and Michigan sites. Will they yield economically viable rare earth deposits?

- How and when Cleveland‑Cliffs details its memorandum of understanding with an undisclosed global steel producer.

- Supplier impact: whether the steelmaker’s diversification into mining will create new procurement or partnership opportunities for adjacent industries.